MyLife Checking Account

Introducing MyLife Checking with MyLife Rewards — an account where everyday life meets rewarding experiences. Earn points on purchases, access exclusive discounts, and more. Elevate your financial experience with this vibrant account! Searching for an account that maximizes savings and offers rewards? Then this is the account for you. You can earn dividends and receive MyLife Rewards benefits with this account.

FEATURES

— Earn Dividends1

— Earn Cash-back Credit2

— MyLife Rewards Benefits*

— Credit/ID Monitoring & Protection

— Cellphone Protection

— Telehealth & more

* Registration required for MyLife Rewards Benefits.

Term APY Minimum Balance Dividend Rate Minimum Balance for APY Met 0.05% $500 0.05% Minimum Balance for APY Not Met – – 0.05% 1 The minimum balance required to earn the stated Annual Percentage Yield is identified above. If you do not maintain the minimum balance, you will not earn the stated Annual Percentage Yield.

For all accounts, dividends are calculated by using the Daily Balance method, which applies a periodic rate to the balance in the account each day.

2 1 In order for the account to qualify for a $1.00 (up to $5.00) monthly credit for a particular qualification cycle, you must satisfy the following requirements: 1) complete ten (10) Mastercard Debit Card PIN or signature purchases for a total of at least $200; 2) initiate at least one (1) ACH or payroll deposit of $500 or more to the account; 3) receive eStatements or Cloud documents; 4) maintain an average daily balance of $500 or more; and 5) have an active loan with us with a balance of at least $1.00.

MyLife Rewards

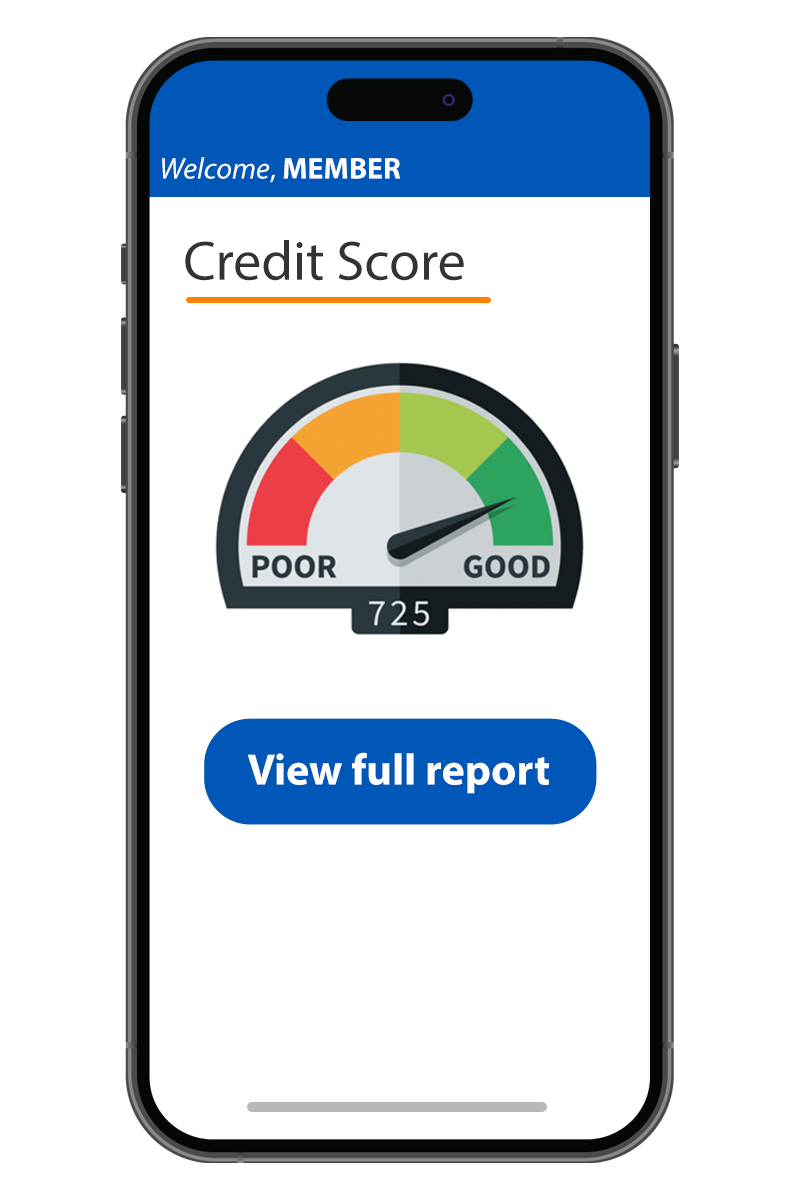

IDProtect® is a premium Identity theft monitoring and resolution service1, that includes credit file monitoring2 and alerts of key changes with Equifax, Experian, and Transunion, ability to request a 3-in-1 report every 90 days or upon receipt of a credit alert, monitoring of over 1,000 data bases and up to $10,000 in identity theft expense reimbursement3, and more.Registration/activation required.

|

|

|

|

1 Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. 2 Credit file monitoring from Experian and TransUnion may take several days to begin following activation. 3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate. |

||

Receive up to $300 of replacement or repair cost for damaged or stolen phones. This protection covers the first three phones listed on your cellular telephone bill.3 Mobile phone bill must be paid through this account.

|

|

|

|

1 Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students. 2 Credit file monitoring from Experian and TransUnion may take several days to begin following activation. 3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate. |

||

Accidents do happen, but you can plan ahead. Unexpected events can leave families into a financial bind. Third party insurance can be costly but security is worth every penny - and its even better when it's free. Coverage divides equally on joint accounts and reduces by 50% at the age of 70.

|

|

|

| 3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate. | ||

Telehealth1 provides access to 24/7 video or phone visits with U.S.-based board-certified, licensed and credentialed doctors ready to care for you and your family. There are zero copays and no surprise bills, plus discounts on prescriptions and lab work. Telehealth covers non-emergency, urgent care for things like allergies, sinus infections, flu, strep throat, bronchitis, hypertension, rashes, acne and more. Therapists and counselors are also there to help work through all kinds of mental and behavioral health, including depression, divorce, grief, loss and addictions. Registration/activation required. |

|

|

|

1 Available for the account holder and their spouse/domestic partner and up to six (6) dependent children age 2 and older. This is not insurance. |

||

Protect your purchases, just by using your card.Buyer's Protection covers items for 90 days from the date of purchase against accidental breakage, fire, or theft. Extended Warranty extends the U.S. manufacturer's original written warranty up to one full year on most new retail purchases if the warranty is less than five years. Item(s) must be purchased entirely with eligible account.

|

|

|

|

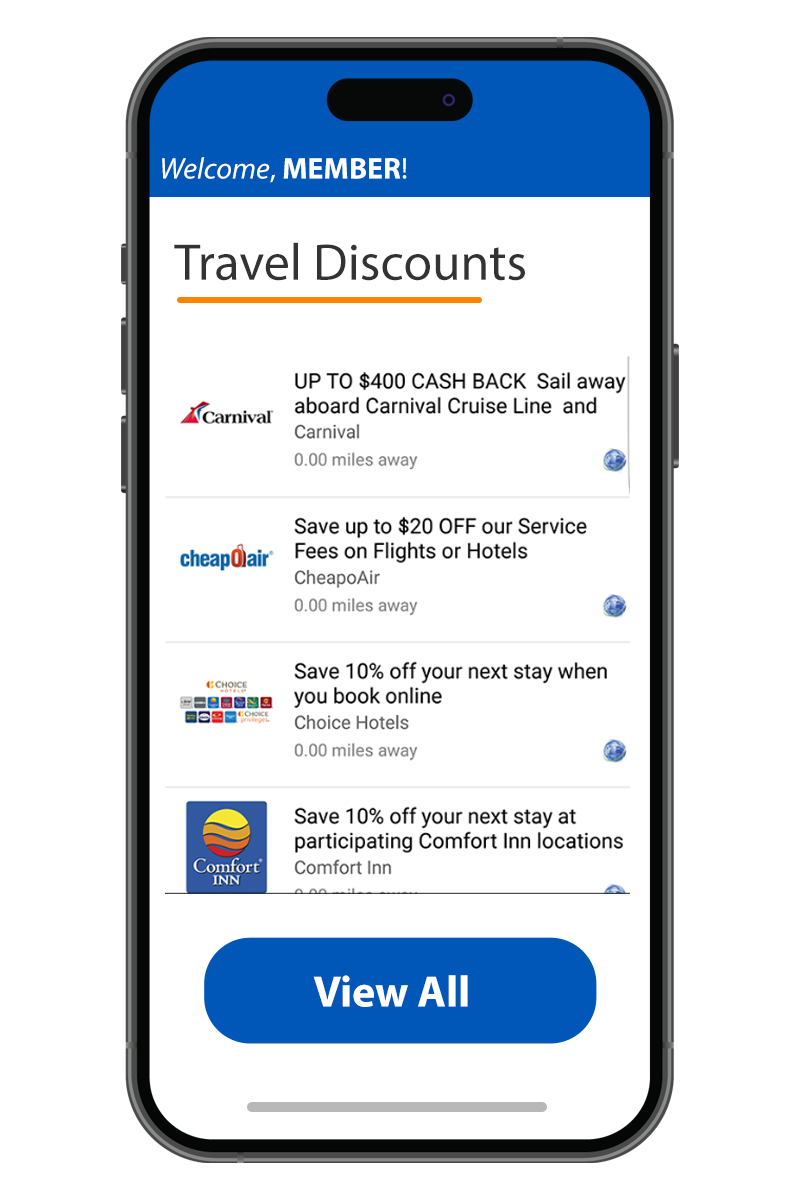

Don't limit your travel rewards to one company's specific criteria.Money-saving discounts from thousands of local and national businesses. Members can redeem and print coupons online or access discounts from their mobile device. Digital Access makes saving super easy and convenient, giving instant savings anywhere and anytime. Registration/activation required. Available online only.

|

|

— Receiving all these services elsewhere at for-profit companies can be costly! Sunbelt members can start with MyLife Checking for as little as $3-$8 / month.

— Rising Sun Checking Account holders (those under eighteen years old) receive MyLife Checking ABSOLUTERLY FREE.

EARN MONTHLY CASH-BACK CREDITS

|

Frequently Asked Questions

To open an account with Sunbelt, you will need to bring in two valid forms of Government Identification. For example, your Drivers License and Social Security Card. Also, proof of residence such as a utility bill or a lease.

There is no opening deposit required for any of Sunbelt's checking accounts!

Sunbelt account holders have access to over 60,000 free ATMs across the United States! Click here to find the free ATM closest to you.

Yes. Your funds are federally insured by the National Credit Union Administration (NCUA) up to $250K.Like the FDIC, the NCUA insures your deposit through the NCUSIF, backed by the full faith and credit of the US government.

- Share Savings Account

- Holiday Club Account

- Money Market Account

Preauthorized or automatic electronic withdrawals such as phone and utility bills. Also, transactions done using online (PC & mobile) and phone transfers using e-Phone, fax, or by calling our Contact Center. This applies when funds are coming from an account type listed above.

Applies whether:

- The funds are being transferred to another account.

- The funds are being sent to a third party via preauthorization, Bill Pay, or wire transfer.

- The funds are being automatically transferred from a Share Savings to a Share Draft Checking to cover an overdraft.

- The funds are a scheduled transfer that was set-up by account holder in home banking

- Transactions from an account type noted below that are completed in-person at a branch or Shared Service Center

- Transactions made using an ATM

- Transfers from an account type noted below that are being applied to a loan account

- Automatic payroll allocations

- Any Share Draft Checking Account transaction

- Transactions completed by mail

- Transactions made by telephone, fax, PC, or mobile device – if it is an official check payable to the member that is mailed to the member

Affected Account Types:

- Share Savings Account

- Holiday Club Account

- Money Market Account

Once you have reached the six (6) allowable transactions in a calendar month, you will not be allowed to make further transfers/withdrawals from the affected account unless they are made in person at a branch location, Shared Service Center or at an ATM.Transaction attempts from an account type noted above will be declined, unless in-person or at an ATM.

HELPFUL TIPS

- Have preauthorized payments (such as phone & utility bills) automatically deducted from a Share Draft account, not a Share Savings account.

- Make one large transfer to your Share Draft Checking to cover anticipated usage, instead of making many small transfers throughout the month.

- Visit a branch or ATM location to make withdrawals or transfers.

- Balance your Share Draft Checking to avoid overdraft transfers from your Share Savings account.

- Apply for a Line of Credit to use as overdraft protection.

- Open a Checking Account. Share Draft accounts are not subject to Reg D restrictions.

LIMITED TRANSACTIONS:

Up to six (6) preauthorized or electronic transactions permitted per calendar month from a non-transaction account.

Non-transaction accounts are:

- Share Savings

- Holiday Club

- Money Market

Transactions done using online (PC & mobile) and phone transfers using Cloud mobile dervices or by calling our Member Service Department from an account type listed above.

This rule applies whether:

- Funds are being transferred to another account

- Funds are being sent to a third party via preauthorization, Bill Pay, or wire transfer

- Funds are automatically transferred from a Share Savings to a Share Draft Checking to cover an overdraft

- Funds are scheduled transfers set-up in home banking

UNLIMITED TRANSACTIONS:

- Made in person

- Made using an ATM

- Made by a letter request (considered the functional equivalent of being physically present)

- Made by telephone, fax, PC, or mobile device – if it is an official check payable to the member that is mailed to the member

- Made by the member to pay a loan the member has with the credit union (including MasterCard)

Already a MyLife Checking Account Holder?For first-time registration, click Begin Registration' to get your access code. Once obtained, click 'Login to MyLife Rewards' or visit Myliferewards.com |

|

Qualifying required for membership. APY = annual percentage yield. All deposits subject to terms listed in Sunbelt's Rates & Services form.