Rewards for everyday spending.

Meet the Sunbelt Advantage Credit Card with MyLife Rewards — where everyday spending brings exceptional rewards! Tailored for those wanting to get the most out of every transaction, this card offers no annual fee and no balance transfer fees, plus the perks of MyLife Rewards. Enjoy benefits that fit your unique lifestyle and financial goals.

No Annual Fees

Most cards charge annual fees upwards of $100. With Sunbelt Advantage, say goodbye to annual fees.No Balance Transfer Fees

Pay off your higher interest card(s) by switching your balance over at no cost.Competitive Rates

Our rates start around four to five percent lower than most of the bigger card companies.MyLife Rewards

Credit and Identity Protection, Cellphone Protection, Travel & Leisure Discouts, and more.

|

The one card that does it all. |

MyLife Rewards

The Sunbelt Advantage Credit Card with MyLife Rewards is your go-to card for travel and shopping discounts, cell phone / identity / credit / life / purchase protection, and the ability to build, maintain, and protect your credit with free credit reports, monitoring, and frequent credit score access.

IDProtect

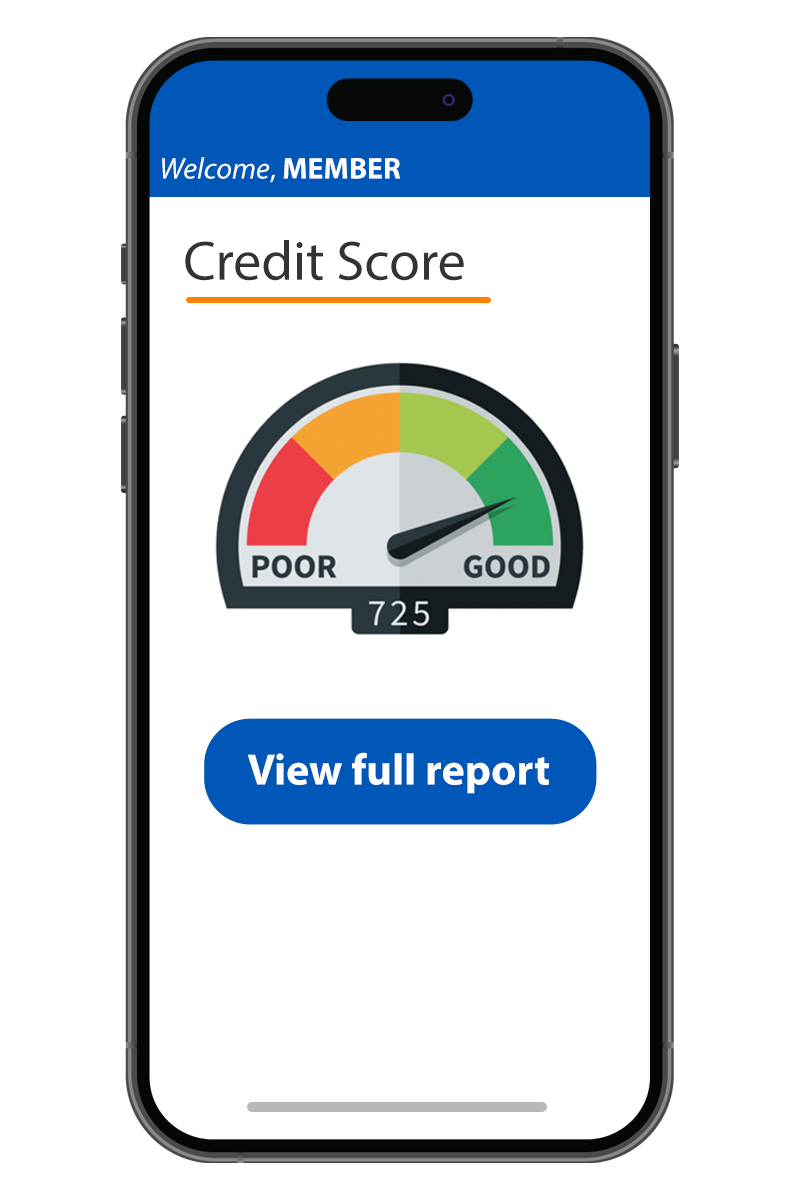

Monitor and protect your credit, credit score, and identity with IDProtect®

IDProtect® is a premium Identity theft monitoring and resolution service1, that includes credit file monitoring2 and alerts of key changes with Equifax, Experian, and Transunion, ability to request a 3-in-1 report every 90 days or upon receipt of a credit alert, monitoring of over 1,000 data bases and up to $10,000 in identity theft expense reimbursement3, and more.

Registration/activation required.

- Credit Report / Score

- Identity / Credit Monitoring

- Identity Theft Reimbursement

1 Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students.

2 Credit file monitoring from Experian and TransUnion may take several days to begin following activation.

3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

Cell Phone Protection

A modern reward for modern tech. We love our phones, but they do break and get lost or stolen.

Receive up to $300 of replacement or repair cost for damaged or stolen phones. This protection covers the first three phones listed on your cellular telephone bill.3

Mobile phone bill must be paid through this account.

- Covers up to 3 phones

- Protects up to $300 per claim

- Amazingly low replacement deductible

1 Benefits are available to personal checking account owner(s), their joint account owners and their eligible family members subject to the terms and conditions for the applicable Benefits. Some Benefits require authentication, registration and/or activation. Benefits are not available to a “signer” on the account who is not an account owner or to businesses, clubs, trusts, organizations and/or churches and their members, or schools and their employees/students.

2 Credit file monitoring from Experian and TransUnion may take several days to begin following activation.

3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

Protection From the Unexpected

Provide security to those who matter most.

Accidents do happen, but you can plan ahead.

Unexpected events can leave families into a financial bind.

Third party insurance can be costly but security is worth every penny - and its even better when it's free.

Coverage divides equally on joint accounts and reduces by 50% at the age of 70.

- Receive up to $10,000 of Accidental Death & Dismemberment Insurance.3,4

3 Special Program Notes: The descriptions herein are summaries only and do not include all terms, conditions and exclusions of the Benefits described. Please refer to the actual Guide to Benefit and/or insurance documents for complete details of coverage and exclusions. Coverage is provided through the company named in the Guide to Benefit or on the certificate of insurance. Insurance product is not insured by NCUA or any Federal Government Agency; not a deposit of or guaranteed by the credit union or any credit union affiliate. Telehealth

MyLife Rewards offers Telehealth services.

Telehealth1 provides access to 24/7 video or phone visits with U.S.-based board-certified, licensed and credentialed doctors ready to care for you and your family.

There are zero copays and no surprise bills, plus discounts on prescriptions and lab work.

Telehealth covers non-emergency, urgent care for things like allergies, sinus infections, flu, strep throat, bronchitis, hypertension, rashes, acne and more. Therapists and counselors are also there to help work through all kinds of mental and behavioral health, including depression, divorce, grief, loss and addictions.

Registration/activation required.

1 Available for the account holder and their spouse/domestic partner and up to six (6) dependent children age 2 and older. This is not insurance.

Buyer's Protection

Protect your purchases, just by using your card.

Buyer's Protection covers items for 90 days from the date of purchase against accidental breakage, fire, or theft. Extended Warranty extends the U.S. manufacturer's original written warranty up to one full year on most new retail purchases if the warranty is less than five years.

Item(s) must be purchased entirely with eligible account.

- Purchase Protection for 90 Days

- Extended 1 Year Warranty on Most Purchases

- Coverage against: Fire, Theft, Breakage, and more

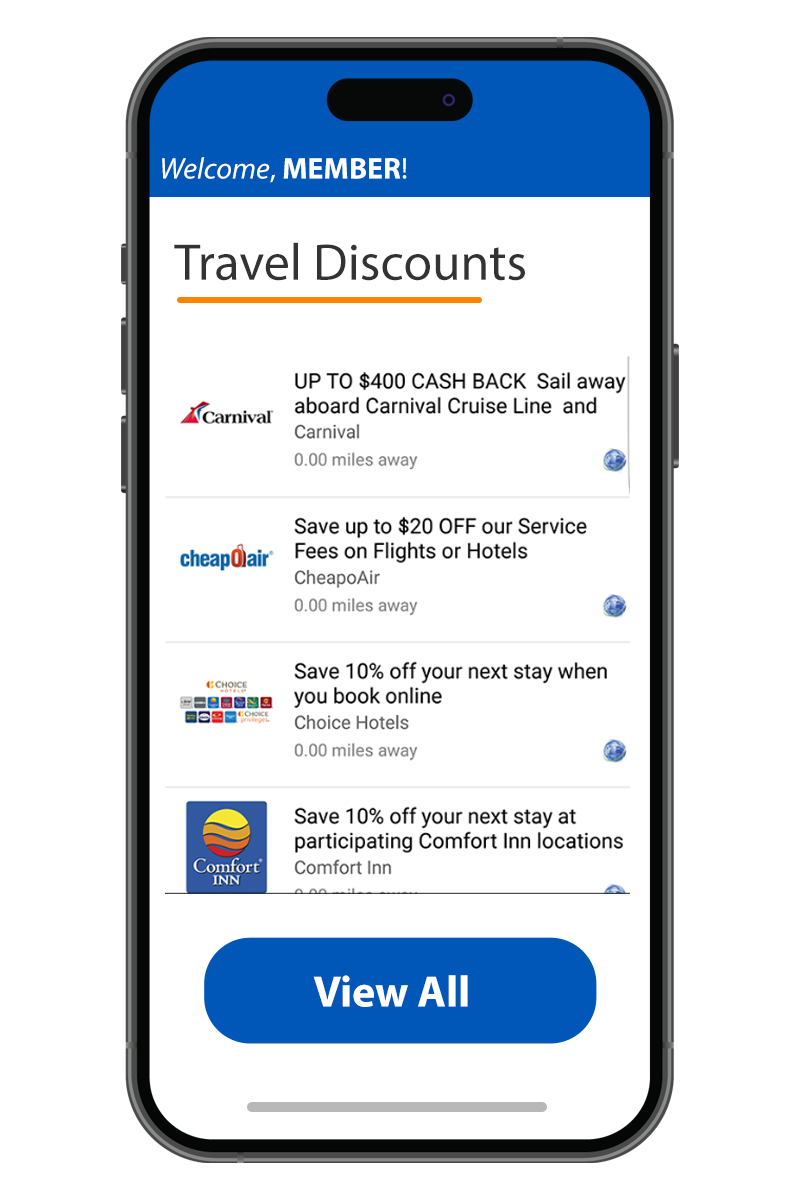

Travel and Leisure Discounts

Don't limit your travel rewards to one company's specific criteria.

Money-saving discounts from thousands of local and national businesses. Members can redeem and print coupons online or access discounts from their mobile device. Digital Access makes saving super easy and convenient, giving instant savings anywhere and anytime.

Registration/activation required. Available online only.

- Savings with Numerous Major Companies

- Airfare, Lodging, Auto Rental, and more

- No Need to Earn & Track Loyalty Points

Credit card optimizer credit card payoff how much do you owe? Roll down your debt

Get Started TodayApply now and we will get to work on the funding you need!

|

Are you a MyLife Credit Card Holder?For first-time registration, click Begin Registration' to get your access code. Once obtained, click 'Login to MyLife Rewards' or visit www.eclubonline.net |

|

1 IDProtect service is a personal identity theft protection service available to Sunbelt VISA Platinum cardholders. The service is available to non-publicly traded businesses and their business owner(s) listed on the account (service not available to employees or authorized signers who are not owners). For revocable grantor trusts, the service is available only when a grantor is serving as a trustee and covers the grantor trustee(s). For all other fiduciary accounts, the service covers the beneficiary, who must be the primary member (Fiduciary is not covered). Service is not available to a "signer" on the account who is not an account owner. Service is not available to clubs, organizations and/or churches and their members, schools and their employees/students.