Cloud Banking

Access your account and bank at your convenience — anytime, anywhere. Enjoy a brighter banking experience with Cloud Banking and Cloud Services. Pay bills, view transaction history, enroll in eStatements, receive account activity alerts and much more.

FEATURES

— View Accounts & Loans

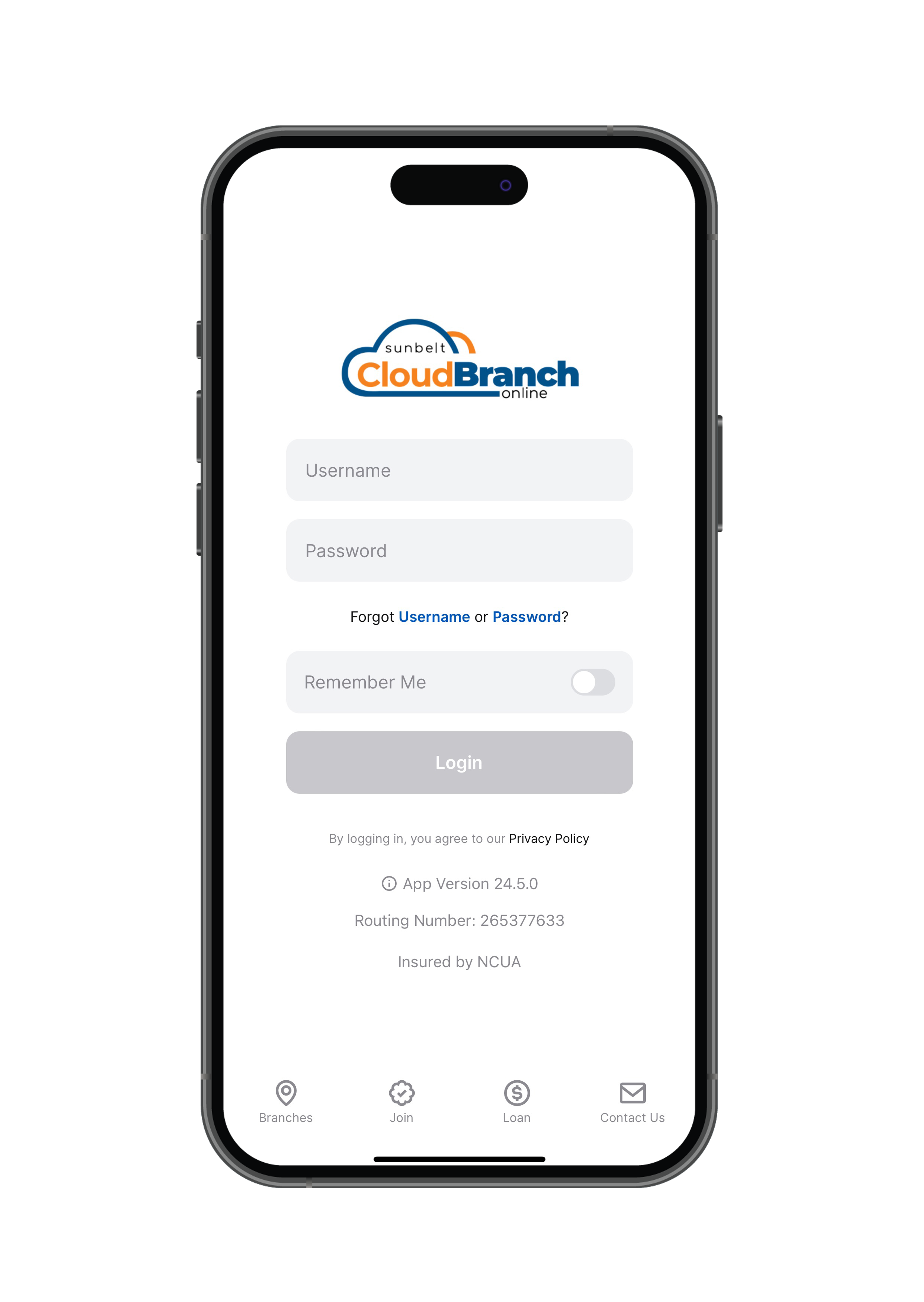

— Access on mobile device, tablet or computer

— Pay Bills

— Transfer Funds

— Deposit Checks & much more!

ACCESS YOUR ACCOUNT – ANYTIME, ANYWHERE!

|

Registration is Easy

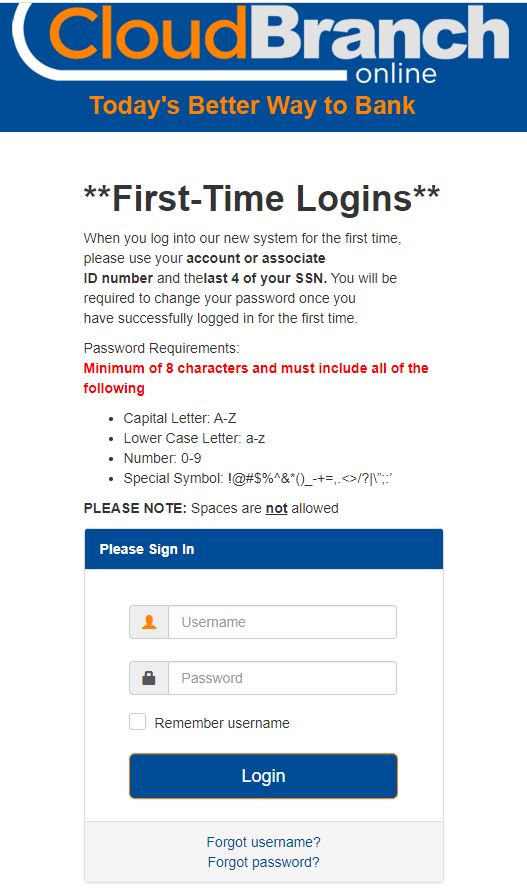

1. FIRST TIME LOGIN

Registration is quick an easy! Click Member Login on sunbeltfcu.org and use the primary member's Member # as the User ID. The password will be the primary member's last 4 of the SSN.

2. FOLLOW ON-SCREEN INSTRUCTIONS

Navigate through the on-screen instructions to complete your Cloud Branch enrollment. Be sure to choose security questions / answers that are easily memorable.

3. DOWNLOAD THE MOBILE APP

After completing your registration, download the app on your Android or iOS device for even easier account access.

Frequently Asked Questions

First time login

New to Sunbelt or the Cloud Branch? Registering is easy and just takes a few moments. Simply click "Login" at the top of the page and enter your credentials.

The User ID is the primary member on the account's member/account number, and the password is the primary member on the account's last four digits of their SSN.

Joint members will need to contact our Account Service Department at 601-649-7181 option 2 to receive your new ID number. Joint members will login using that number and the last four of their SSN.

Upon login, simply follow the on-screen instructions to complete your new account registration.

- Share Savings Account

- Holiday Club Account

- Money Market Account

Preauthorized or automatic electronic withdrawals such as phone and utility bills. Also, transactions done using online (PC & mobile) and phone transfers using e-Phone, fax, or by calling our Contact Center. This applies when funds are coming from an account type listed above.

Applies whether:

- The funds are being transferred to another account.

- The funds are being sent to a third party via preauthorization, Bill Pay, or wire transfer.

- The funds are being automatically transferred from a Share Savings to a Share Draft Checking to cover an overdraft.

- The funds are a scheduled transfer that was set-up by account holder in home banking

- Transactions from an account type noted below that are completed in-person at a branch or Shared Service Center

- Transactions made using an ATM

- Transfers from an account type noted below that are being applied to a loan account

- Automatic payroll allocations

- Any Share Draft Checking Account transaction

- Transactions completed by mail

- Transactions made by telephone, fax, PC, or mobile device – if it is an official check payable to the member that is mailed to the member

Affected Account Types:

- Share Savings Account

- Holiday Club Account

- Money Market Account

Once you have reached the six (6) allowable transactions in a calendar month, you will not be allowed to make further transfers/withdrawals from the affected account unless they are made in person at a branch location, Shared Service Center or at an ATM.Transaction attempts from an account type noted above will be declined, unless in-person or at an ATM.

HELPFUL TIPS

- Have preauthorized payments (such as phone & utility bills) automatically deducted from a Share Draft account, not a Share Savings account.

- Make one large transfer to your Share Draft Checking to cover anticipated usage, instead of making many small transfers throughout the month.

- Visit a branch or ATM location to make withdrawals or transfers.

- Balance your Share Draft Checking to avoid overdraft transfers from your Share Savings account.

- Apply for a Line of Credit to use as overdraft protection.

- Open a Checking Account. Share Draft accounts are not subject to Reg D restrictions.

LIMITED TRANSACTIONS:

Up to six (6) preauthorized or electronic transactions permitted per calendar month from a non-transaction account.

Non-transaction accounts are:

- Share Savings

- Holiday Club

- Money Market

Transactions done using online (PC & mobile) and phone transfers using Cloud mobile dervices or by calling our Member Service Department from an account type listed above.

This rule applies whether:

- Funds are being transferred to another account

- Funds are being sent to a third party via preauthorization, Bill Pay, or wire transfer

- Funds are automatically transferred from a Share Savings to a Share Draft Checking to cover an overdraft

- Funds are scheduled transfers set-up in home banking

UNLIMITED TRANSACTIONS:

- Made in person

- Made using an ATM

- Made by a letter request (considered the functional equivalent of being physically present)

- Made by telephone, fax, PC, or mobile device – if it is an official check payable to the member that is mailed to the member

- Made by the member to pay a loan the member has with the credit union (including MasterCard)